Ingestion Agent: Address Cleansing

Streamlining the Underwriter’s workflow by building an AI agent that ingests complex submission documents, reducing time from submission-to-binding. This allows insurers to price risk with greater accuracy and focus on higher-value decision-making.

Problem and Context

The underwriting process is built on expertise, judgment, and risk evaluation, but those strengths are undermined by the way information flows today. Submissions often arrive as sprawling, inconsistent documents, with exposure schedules, claims histories, and policy details scattered across formats. Before any pricing or risk assessment can even begin, underwriters are forced into hours of manual data entry, cleaning, and reconciliation. What should be a strategic role focused on evaluating risk and structuring deals instead turns into an administrative burden.

Problem statement:

Underwriters spend excessive time manually cleansing address data in large SOVs because submissions are incomplete and inconsistent, leading to unreliable geocoding and limiting how much pricing can safely depend on address‑level risk factors.

Key problem to solve:

Underwriters lose valuable time on tedious, repetitive work.

Rekeying submission data into pricing models is time-consuming, exhausting, and prone to human error.

The process can take 8–20 hours, depending on model complexity and submission quality.

Data is inconsistent — scattered, unformatted, and varying from broker to broker.

This lack of standardisation makes it difficult to create efficient, repeatable workflows.

Process

Customer Discovery

Working closely with Product Management, we organised discovery calls with key customers already enrolled in the beta program for the Property line of business and committed as design partners.

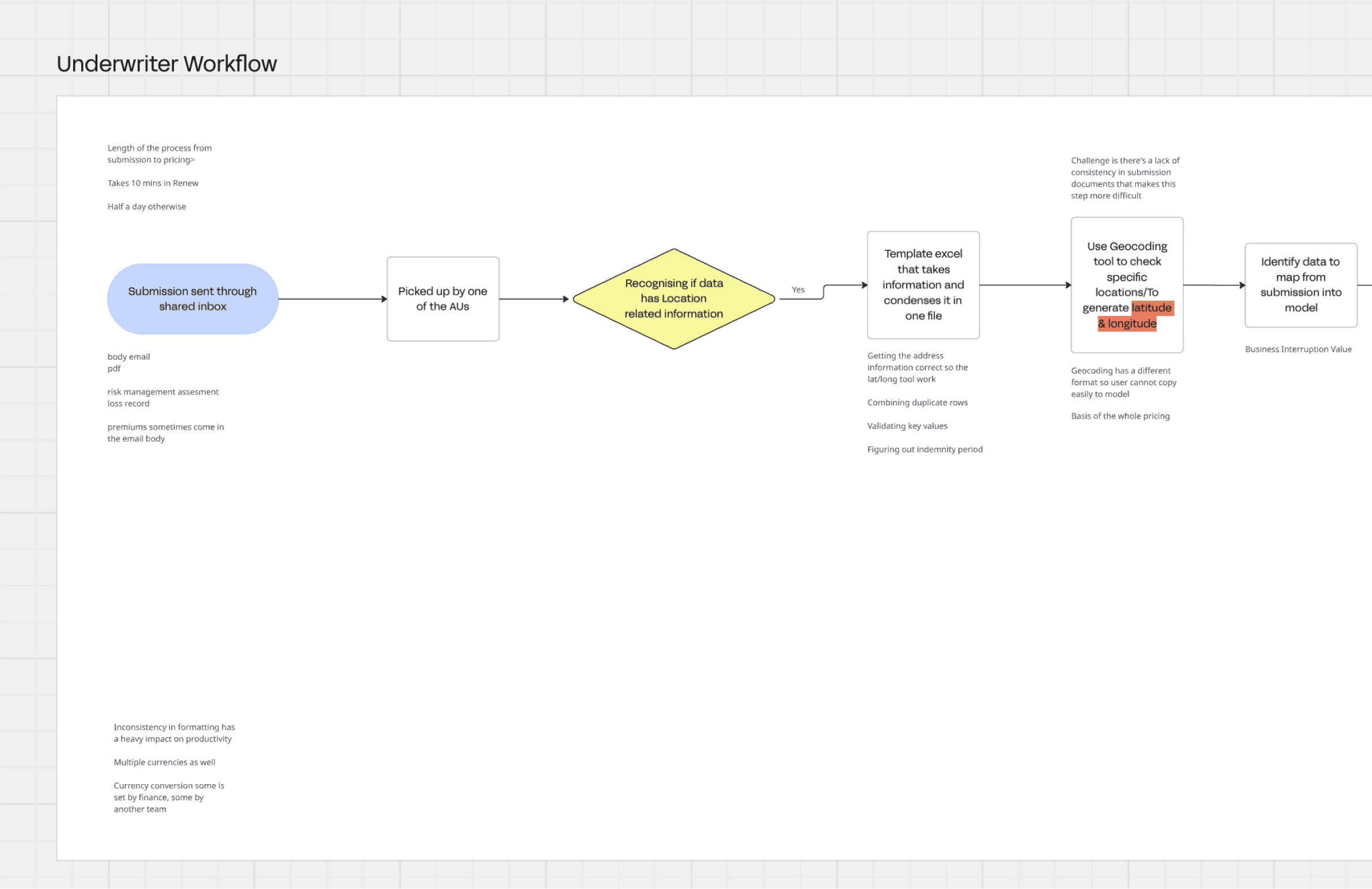

We ran a workshop where customers walked us through the underwriting workflow step by step, as if we were new Assistant Underwriters.

During each session, we asked probing follow-up questions and built a live workflow diagram to capture every stage, including edge cases.

After several calls, we collaborated with Engineering to identify quick wins that aligned both with user needs and the existing roadmap.

Key Insight

A recurring pain point across customers was Address Cleansing. Submissions often contained unformatted addresses, inconsistent country-level formatting, and incomplete postcodes. This lack of standardization created friction and delays in the underwriting process. Recognizing the gap, we prioritized solving this problem to deliver immediate value to customers.

Design Exploration

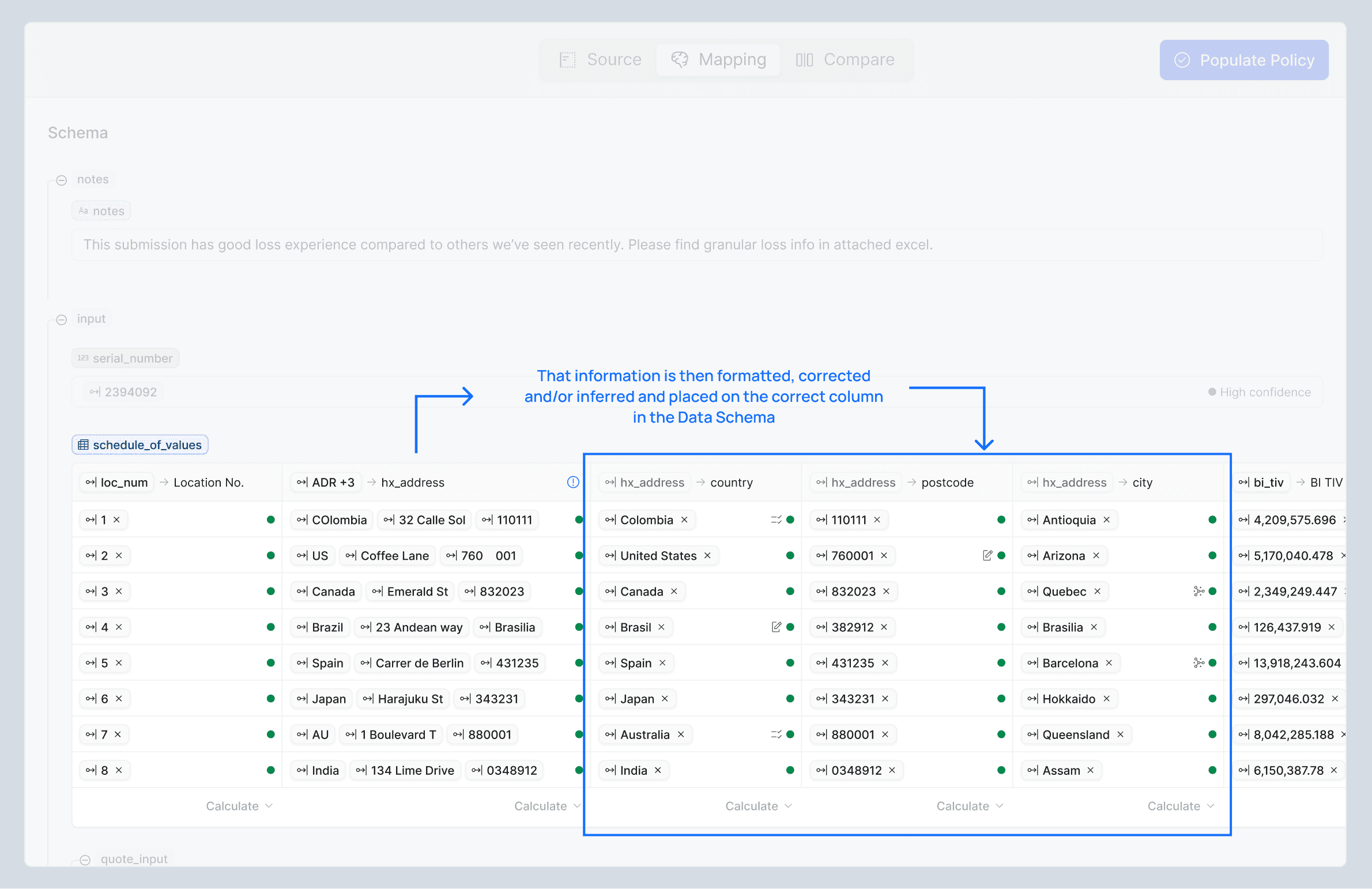

During the design phase, I explored the concept of creating a virtual aggregation column to manage address data cleansing. Instead of forcing users to manually format inputs, the virtual column would consolidate address information, apply the required formatting, and then distribute the cleaned data into the appropriate output fields for the pricing model. This approach ensured flexibility without altering the model’s underlying structure.

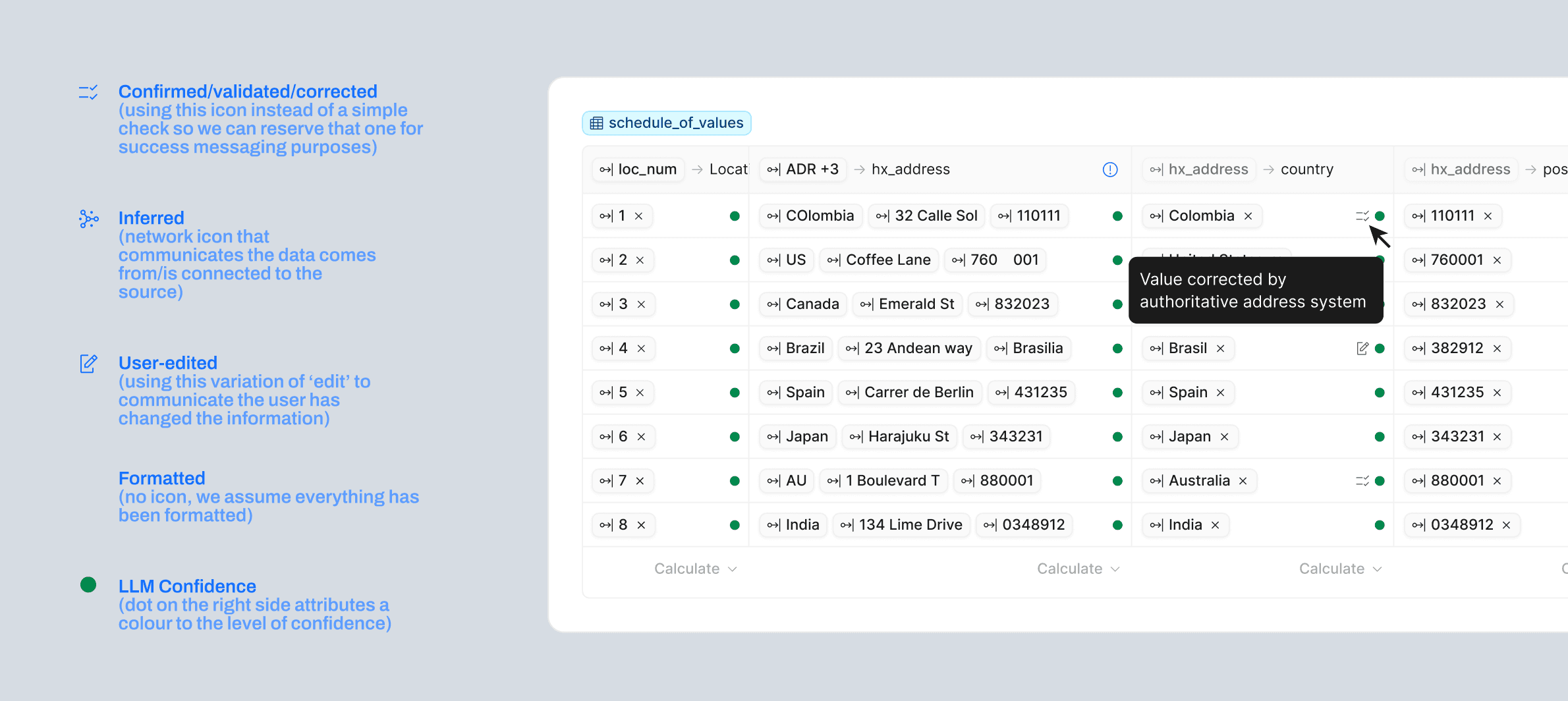

To support human-in-the-loop (HITL) interaction, we defined several cleansing outcomes that needed to be transparent to users:

Formatted – standardised for consistency

Corrected – adjusted where obvious errors existed

Inferred – filled in when information was missing but could be reasonably derived

These states were surfaced through affordances added next to the field. On hover, explanatory copy described what action the system had taken, ensuring users understood the nature of the transformation.

The virtual column itself was never passed to the model—it acted only as a point of aggregation. Users retained the ability to:

Edit values directly if the LLM-backed agent made a mistake

Choose which original columns contributed to the aggregation, giving them control over the process

The mapping between the virtual column and individual fields (e.g., street, country, postcode, state) was not user-editable. These settings were configured at code level by actuaries, tailored to each model, customer, and line of business to ensure consistency. An important aspect of this flexibility is that actuaries retain full control over how information is mapped and passed into the pricing model. As part of implementation, they must decide how to structure this mapping and how to roll it out to their own “customers” — the underwriters — ensuring the tool works seamlessly within each underwriting context.

Finally, we validated these design decisions through user testing. We presented interactive prototypes to the same customers who had participated in earlier discovery sessions, confirming our assumptions and ensuring the experience felt smooth, intuitive, and valuable enough to serve as an MVP for their underwriting teams. These sessions generated great insights that helped refine the solution, directly shaping the improved experience we delivered just a few weeks later.

Outcome and Impact

Accelerated workflow with up to a 5x faster submission-to-bind process, shifting underwriter time from manual entry to risk evaluation and decision-making.

Built customer confidence by demonstrating a human-in-the-loop approach that preserved accuracy while reducing manual workload, helping close deals with initially hesitant prospects.

Opened future opportunities through potential enhancements like table mapping controls, column and row merging, and table summaries, enabling faster validation of mappings before populating pricing models.

These improvements, along with other iterative refinements, contributed to a major commercial milestone that lead to adoption by several of the largest enterprise insurers in the London market.